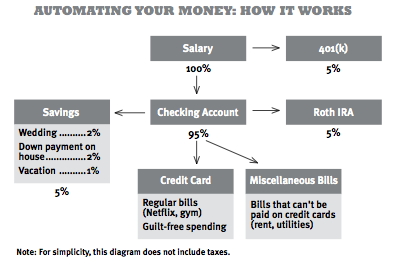

Remi Sethi has a great chart laying out what fully automated finances would look like.

While I really aspire to reach that level of automation, I'm really happy with a *nearly* automated system that's been about a year in the making.

What is Automated

- income is direct-deposited into our checking account, monthly for me and weekly for the hubby

- my retirement contributions (15%) are automatically deducted from my check before I ever see it

- savings is scheduled once a month from my check (12%) and once a week from hubby's check (7%)

- started a Roth IRA for hubby with small monthly scheduled deposit, will ramp up when the truck is paid off

- most of the bills are automatically paid: electric, gas, cell, student loan, child support, truck loan

- credit cards are automatically paid in full at the beginning of the month

What is Not Automated

- some bills are manually entered into billpay because the amounts change from month-to-month or they are not delivered electronically: cable, water, insurance, mortgage

- union dues for the hubby are paid by mailing a physical check and are due monthly

- church tithes are paid with a physical check each week

Our savings aren't broken out into several sub-goals yet. There are currently two piles, emergency savings (untouchable) and regular savings (spendable). The goals I'd like to set up as separate funds are: next car, gifts, and home improvement. I'll try and set those up in my Ing account soon and report back with the math for setting those goals.

Julie Pickett-Hall

You also might be interested in:

- another post from Remi on how to set up sub-goal accounts using your Ing account

- comment or email me to get a $25 bonus when you sign up a new Ing account

No comments:

Post a Comment